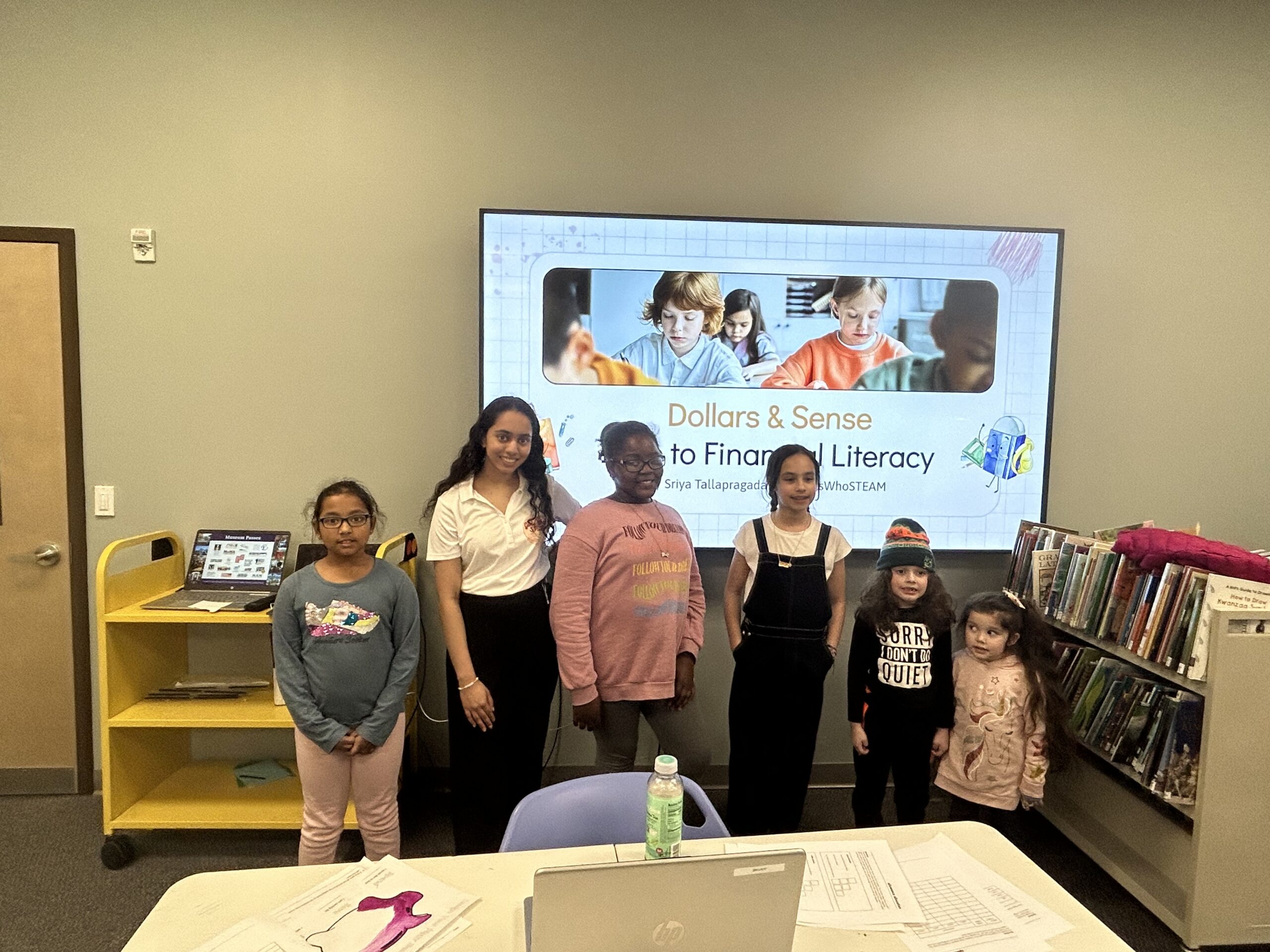

Financial Wellness

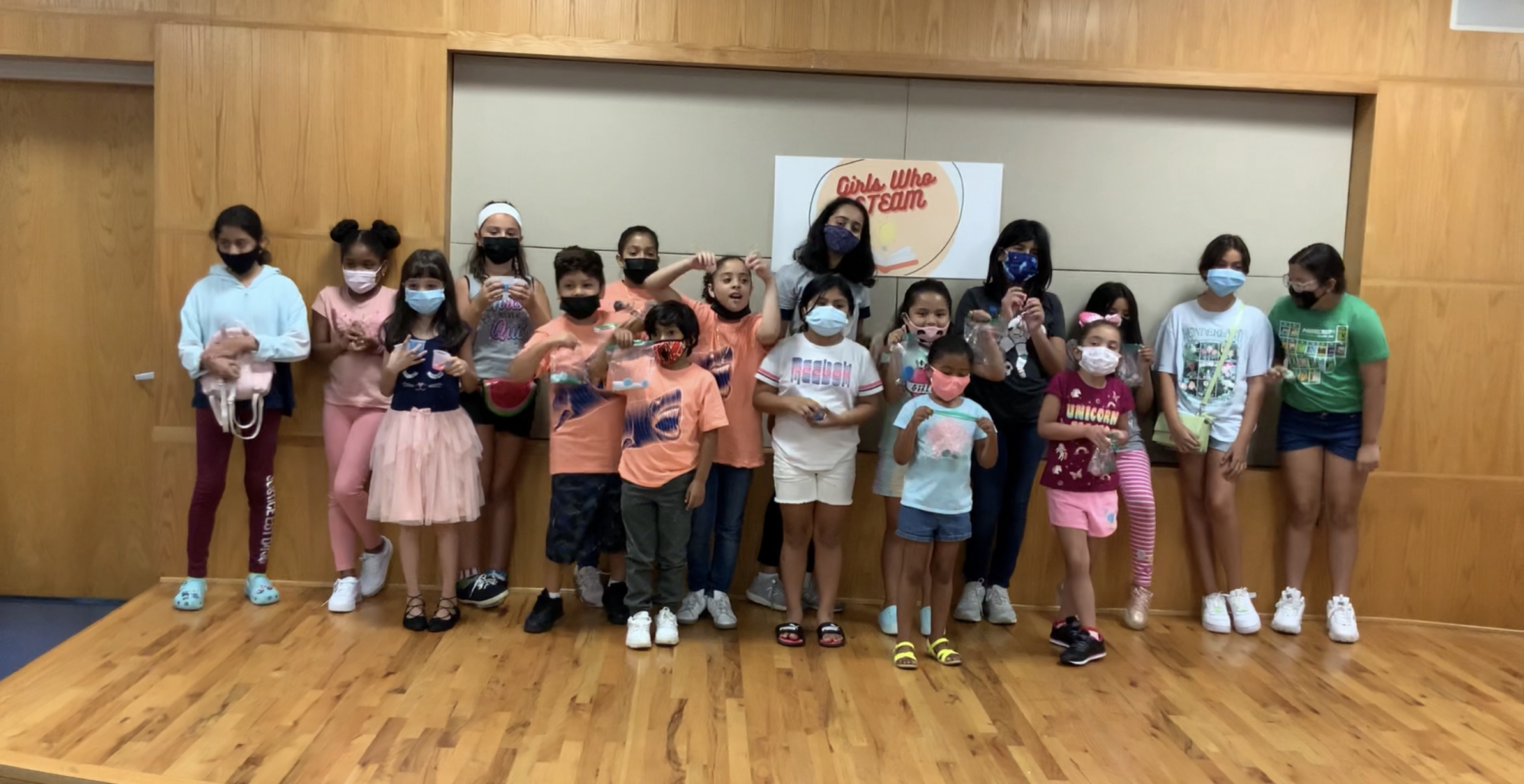

Saving and budgeting are skills that are essential to being a financially successful adult and also require discipline that should be practiced from a young age. A strong financial education allows kids and teens to know where to spend and where to save their money, as well as how to create and stick with a budget. Our financial literacy classes teach students the basics of money management: budgeting, saving, debt, investing, giving and more. It also helps them understand the value of money. That way, they will know the importance of budgeting, saving and avoiding unnecessary expenditures.

Studies show that a majority of young people in the United States have poor financial literacy. In 2010, the Treasury Department and Department of Education assessed financial literacy in U.S. high schools, and the results were not good: the average financial literacy score of nearly 77,000 students was 70 percent. (Source: Heartland Institute of Financial Education)

The financial literacy program that we offer is both comprehensive and hands-on. We provide coaching to go over specific financial scenarios and strategies for managing money. We specifically focus on leadership in finance, and what that would mean in the business industry. Through the interactive scenarios we go through, it is our hope that our program allows girls to develop as leaders, as well as learn to work as a team and problem solve.